Completing the Free Application for Federal Student Aid (FAFSA) is a pivotal step for millions of students and families each year, yet its complexity often creates a significant barrier to accessing crucial financial support. The form’s detailed questions about income, assets, and household size can be daunting, leading to errors, missed deadlines, and ultimately, less financial aid. In this digital age, a new resource has emerged to demystify this process: the online FAFSA advisor. This professional guidance, delivered virtually, is transforming how applicants approach financial aid, offering expert support that can mean the difference between securing maximum funding and leaving money on the table. Whether you’re a first-time filer navigating the system or a returning student facing new circumstances, understanding how an online advisor works can streamline your application and boost your confidence.

What Is an Online FAFSA Advisor?

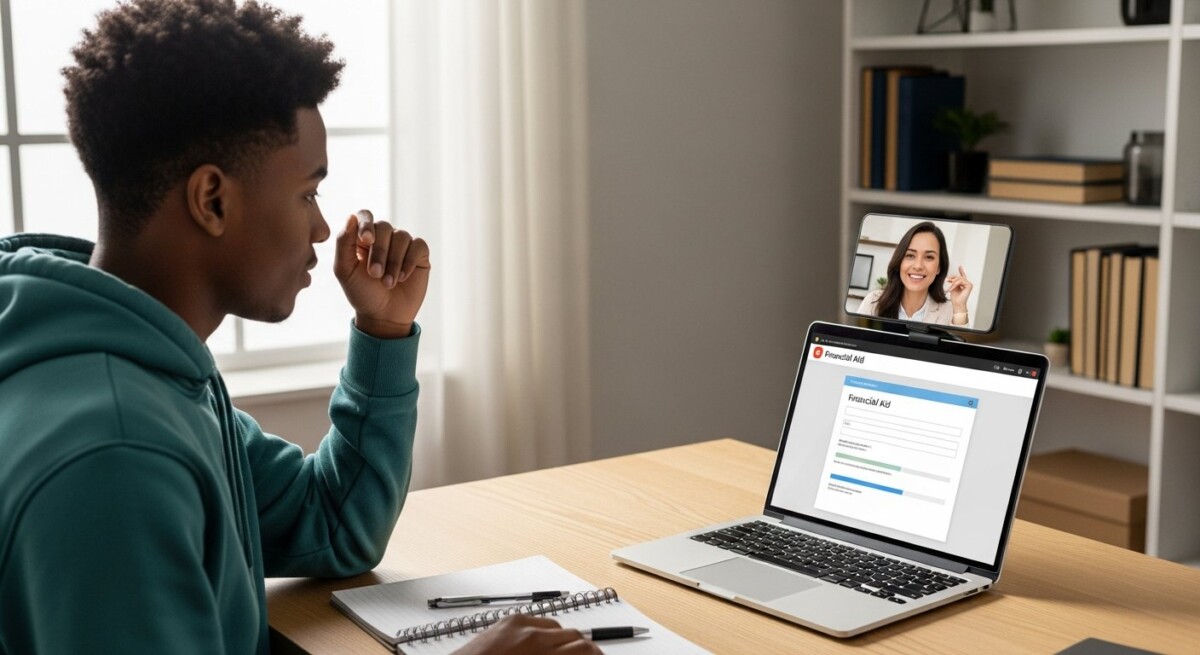

An online FAFSA advisor is a qualified professional who provides remote, expert assistance to students and families completing the FAFSA. Unlike generic online tools or chatbots, a true advisor offers personalized, human-guided support. This service model leverages video calls, screen sharing, secure document portals, and real-time messaging to replicate the experience of in-person financial aid counseling, but with greater convenience and accessibility. Advisors are typically well-versed in federal aid guidelines, state-specific grant programs, and institutional methodologies used by colleges to calculate financial need. Their primary goal is to ensure your FAFSA is accurate, optimized, and submitted correctly and on time, which directly influences your eligibility for grants, work-study, and federal student loans. For many families, this targeted help is invaluable, especially when navigating complex financial situations such as business ownership, divorce, or unusual income years.

The scope of an advisor’s role often extends beyond just form-filling. They help you gather the necessary documentation, interpret confusing terminology, and plan for the steps that come after submission. A key part of their service is explaining your Student Aid Report (SAR) and helping you understand your Expected Family Contribution (EFC), now known as the Student Aid Index (SAI). This holistic approach ensures you are not just submitting a form, but are fully informed about your financial aid journey. Many services also provide year-round support for subsequent renewals and appeals, making them a long-term partner in college affordability.

Key Benefits of Using a Virtual FAFSA Guidance Service

Engaging an online FAFSA advisor offers several distinct advantages over attempting the process alone or relying solely on free, automated resources. The first and most significant benefit is accuracy. Even small mistakes on the FAFSA, like transposing numbers or misreporting household size, can delay processing or reduce your aid eligibility. An advisor acts as a meticulous reviewer, catching errors before submission. Secondly, these services provide optimization. There are legal and strategic ways to present your financial information that can positively impact your aid calculation. An advisor understands these nuances and can guide you in reporting assets and income appropriately.

Beyond accuracy and optimization, an online advisor delivers convenience and reduces stress. The ability to schedule sessions outside traditional business hours and receive help from your own home removes logistical hurdles. This is particularly beneficial for non-traditional students, working adults, and families in rural areas. Furthermore, the personalized attention ensures your unique circumstances are accounted for correctly, which generic online tools cannot do. To understand the full scope of strategic preparation, our guide on essential online FAFSA tips for a smooth application complements the advisor’s role with foundational knowledge.

Consider these core benefits when evaluating if an online FAFSA advisor is right for you:

- Maximized Aid Potential: Expert strategies can help ensure you qualify for the maximum federal, state, and institutional aid for which you are eligible.

- Error Reduction: Professional review minimizes mistakes that cause processing delays or require cumbersome corrections.

- Time Savings: Streamlined guidance cuts through complexity, saving you hours of research and frustration.

- Clarity and Confidence: You gain a clear understanding of the process and your resulting financial aid package, empowering better decision-making.

- Ongoing Support: Many advisors offer help with financial aid award letter comparisons and appeal letters if the initial offer is insufficient.

How to Choose a Reputable Online FAFSA Advisor

With the growing demand for financial aid assistance, numerous services now offer online FAFSA help. However, quality and ethics can vary widely. Selecting a reputable advisor is critical to protecting your personal data and ensuring you receive legitimate, beneficial guidance. Start by verifying credentials. Look for advisors who are certified financial aid professionals, often holding designations like Certified College Planning Specialist (CCPS) or who have extensive experience working in college financial aid offices. Be wary of any service that guarantees a specific dollar amount in aid, as this is unethical and impossible to promise.

Transparency about fees is another crucial factor. Understand exactly what the service costs, what is included (e.g., number of consultation hours, review cycles, appeal support), and whether there is a money-back guarantee. Reputable services will never ask for your FSA ID password; they should guide you through entering information yourself during a shared screen session. It’s also wise to check for reviews or testimonials from past clients and to ensure the service has a clear privacy policy detailing how your sensitive financial information will be protected. A trustworthy advisor will always emphasize that their role is to help you report information accurately, not to manipulate data unethically.

Finally, assess the communication style and technological platform. You should feel comfortable with the advisor and confident in their ability to explain concepts clearly. The platform used for meetings and document sharing should be secure and user-friendly. A good initial consultation will involve the advisor asking detailed questions about your situation to assess how they can help, rather than making immediate sales pitches. This due diligence ensures you partner with a professional who acts in your best interest.

Integrating Advisor Help with Other Financial Planning Tools

An online FAFSA advisor is a powerful component of a comprehensive college funding strategy, but it should be integrated with other tools and resources. Before your advisor session, using a free online FAFSA estimator to plan your college funding can provide a valuable baseline understanding of your potential aid. This preliminary estimate helps set realistic expectations and allows you to come to your advisor with informed questions. Furthermore, the FAFSA is just one piece of the puzzle. A complete financial plan should also include a robust search for scholarships and grants that do not require repayment.

For students seeking to minimize loan debt, exploring all avenues of free money is essential. A great starting point for this broader search is the Scholarship & Financial Aid Resources hub, which aggregates opportunities beyond federal aid. Your online FAFSA advisor can often guide you on where to look for these external awards and how to report them on your financial aid application. Additionally, consider how your chosen colleges package aid. Some institutions are more generous with grants than others. Your advisor can help you interpret award letters and understand the true net cost after all aid is applied, enabling you to make a financially sound college choice.

Addressing Common FAFSA Challenges with Expert Guidance

Certain life situations create particularly tricky scenarios on the FAFSA. An online advisor’s expertise becomes especially valuable here. For example, students with divorced or separated parents must determine which parent’s financial information to report, a rule that often causes confusion. Similarly, families who own a business or farm, have experienced a significant drop in income, or have multiple family members in college simultaneously face complex reporting requirements. An advisor can clarify the exact rules and documentation needed for these special circumstances.

Another major challenge is understanding how different types of assets affect the aid calculation. Reporting retirement accounts, home equity, and sibling assets incorrectly is a common pitfall. A knowledgeable advisor will walk you through the FAFSA’s asset protection allowances and exclusions, ensuring you don’t inadvertently over-report. They can also advise on the timing of income and payments, as the FAFSA uses “prior-prior year” tax data, which can sometimes misrepresent a family’s current financial reality. In such cases, an advisor can guide you through the process of submitting a professional judgment appeal to the college’s financial aid office, explaining your situation formally to potentially secure additional need-based aid.

Frequently Asked Questions

Is an online FAFSA advisor worth the cost?

For many families, the investment can pay for itself many times over. If an advisor’s guidance helps you avoid errors that delay aid, qualify for even one additional grant, or secure a more favorable aid package, the financial return can far exceed the service fee. It’s an investment in accuracy, optimization, and peace of mind.

Can’t I get the same help for free from my school counselor?

High school counselors are an excellent resource, but they are often managing hundreds of students and may not have the capacity for detailed, one-on-one FAFSA review. An online FAFSA advisor provides dedicated, appointment-based time focused solely on your application’s specifics.

How early should I contact an online FAFSA advisor?

Ideally, reach out several months before the FAFSA opens (October 1). This allows time for an initial consultation, document gathering, and strategic planning. However, advisors can provide valuable help at any point before your state and college deadlines.

Will an advisor have access to my personal tax information?

A reputable advisor will never ask for your FSA ID password. They will use the IRS Data Retrieval Tool (DRT) guidance and review documents you choose to share via a secure portal. You maintain control over your data and input all information yourself during guided sessions.

What if I need help after submitting the FAFSA?

Many online FAFSA advisory services include post-submission support, such as reviewing your Student Aid Report (SAR), helping interpret financial aid award letters from colleges, and assisting with appeal letters if your financial circumstances change or the initial offer is inadequate.

Navigating the financial aid landscape requires precision, timing, and a clear understanding of intricate rules. An online FAFSA advisor serves as a dedicated navigator, transforming a stressful administrative task into a strategic step toward funding your education. By providing personalized, expert support, these professionals help ensure you access every dollar of aid for which you qualify, allowing you to focus on your academic goals rather than financial uncertainty. As you plan for college costs, consider how this targeted guidance could be a pivotal part of your success, turning the complexity of the FAFSA into a manageable, and even empowering, process.