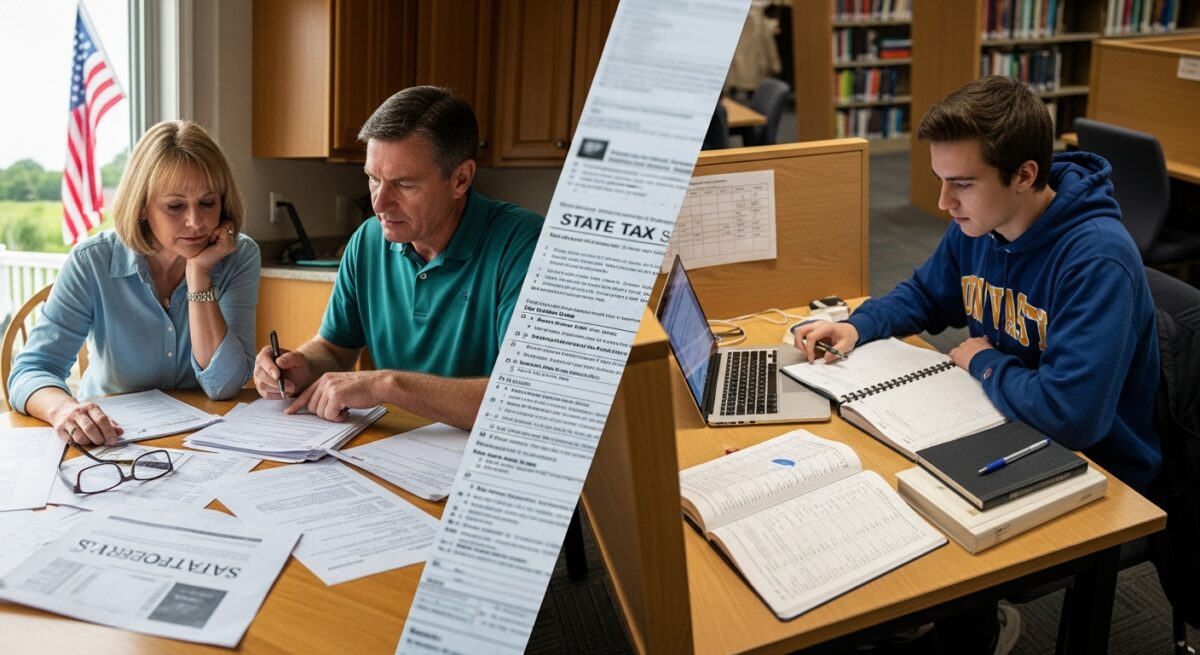

It’s a common frustration for students and parents looking beyond their home state: a public university’s tuition price suddenly triples or quadruples. The stark difference between in-state and out-of-state tuition fees is one of the most significant financial factors in American higher education. While it can feel like a punitive surcharge, the rationale is deeply embedded in the funding model and social contract of public universities. The practice of charging non-resident tuition isn’t about gatekeeping; it’s primarily about balancing budgets and fulfilling a core mission to the taxpayers who fund the institution.

The Taxpayer Funding Model: A Reciprocal Obligation

Public colleges and universities in the United States are not purely market-driven entities. They are state-supported institutions, meaning a substantial portion of their operating revenue comes from state tax dollars. This funding originates from the residents and businesses within the state through income, sales, and property taxes. In return for this ongoing financial support, the state government, acting as a steward of public funds, mandates that these institutions provide a direct benefit to the state’s citizens. The most tangible form of this benefit is subsidized tuition. The in-state tuition rate reflects only a fraction of the total cost of education, with state appropriations covering the remainder. Non-resident students and their families have not contributed to this tax base. Therefore, they are not entitled to the subsidized rate and are asked to pay a rate much closer to, or even exceeding, the full, unsubsidized cost of their education. This creates a two-tiered pricing system that is fundamentally about fairness to the funding source.

This model creates a clear economic relationship. States invest in their public universities to cultivate an educated workforce, drive in-state economic development, and elevate the overall quality of life for residents. Offering discounted tuition to residents is an investment in the state’s own human capital. When a student from another state enrolls, that direct return on investment for the funding state becomes less certain, as the graduate may leave to work elsewhere. The higher non-resident tuition helps offset this uncertainty and ensures that the institution remains financially viable while still being able to attract a diverse student body from across the country and the world.

Calculating the True Cost of Education

What exactly are students paying for? The non-resident tuition rate is often called the “full freight” or “sticker” price, but even this is typically less than the true per-student cost when all expenses are considered. Universities engage in complex cost accounting to determine these rates. The goal is for non-resident tuition, along with other revenue streams like endowments and grants, to cover the complete marginal cost of educating an additional student. This includes direct instructional costs (faculty salaries, classroom supplies), student services (advising, health centers, counseling), administrative overhead, and a share of the maintenance for campus infrastructure (libraries, labs, utilities).

For example, a university’s budget analysis might reveal that the total cost to educate one undergraduate for a year is $30,000. The state legislature provides an appropriation that covers $15,000 of that cost for each in-state student. Therefore, the in-state tuition is set at $15,000. The non-resident student, not benefiting from that state subsidy, is charged a rate of $30,000 or slightly higher. This calculation ensures that the enrollment of non-resident students does not create a financial burden on the institution or, by extension, the state’s taxpayers. It’s a pragmatic approach to budgeting that allows schools to maintain quality and access for their primary constituency. Understanding these calculations can also help families decode other fees, as detailed in resources that explain the rationale behind various institutional charges, such as our guide on Why Do Colleges Charge Extra Fees? Explaining Hidden Add-Ons.

Strategic Benefits of Enrolling Non-Resident Students

Despite the higher price tag, public universities actively recruit non-resident students. The revenue generated from non-resident tuition is a critical financial lever. It provides discretionary funds that can be used to enhance the university in ways that benefit all students. This revenue often supports prestigious academic programs, funds cutting-edge research, renovates facilities, and provides need-based or merit-based financial aid for both in-state and out-of-state students. In an era of fluctuating and often declining state support, non-resident tuition revenue provides a buffer against budget cuts and allows for long-term strategic planning.

Beyond finances, non-resident students contribute to the educational and social fabric of the campus. They bring geographic, cultural, and intellectual diversity that enriches classroom discussions and campus life. This exposure prepares all students, in-state and out-of-state, for a globalized workforce. For the institution, a strong national and international applicant pool boosts selectivity and prestige, which can improve rankings and attract top faculty. Thus, while non-resident tuition is high, it is part of a value exchange: students gain access to a desired program and experience, and the university gains financial stability and a more vibrant community.

How States and Institutions Manage Residency

Given the high stakes, states have strict, legally defined criteria for establishing residency for tuition purposes. These rules are designed to prevent “tuition migration,” where a student moves to a state primarily to obtain the subsidized tuition rate without a genuine intent to become a permanent resident. Common requirements include living in the state for a minimum period (often 12 consecutive months) for purposes other than education, demonstrating financial independence, obtaining a state driver’s license, registering to vote in the state, and filing state income taxes as a resident. The burden of proof is on the student. It’s crucial for anyone considering establishing residency to research the specific statutes of the state and university well in advance, as the process is intentionally rigorous and time-consuming. For those navigating these complex decisions, seeking out clear college degree information from authoritative sources is an essential first step in educational planning.

Navigating the Cost: Options for Out-of-State Students

Facing a non-resident tuition bill can be daunting, but several pathways can reduce the cost. Awareness and proactive planning are key.

First, many public university systems offer tuition reciprocity agreements with neighboring states. Programs like the Midwest Student Exchange Program (MSEP) or the Western Undergraduate Exchange (WUE) allow students from participating states to attend public institutions in other member states at a reduced rate, often 150% of the in-state tuition instead of the full non-resident rate. This can represent savings of tens of thousands of dollars.

Second, merit-based scholarships specifically for non-resident students are a common recruitment tool. Universities use these awards to attract high-achieving students who will enhance their academic profile. These scholarships can sometimes reduce the cost to near in-state levels.

Here are the primary strategies students use to mitigate non-resident tuition costs:

- Tuition Reciprocity Agreements: Research regional compacts like WUE, MSEP, or the New England Regional Student Program.

- Non-Resident Merit Scholarships: Apply to schools where your academic profile exceeds the median admitted student to be competitive for these awards.

- Establishing Residency: For graduate or non-traditional students, meticulously following state rules to gain residency after the first year can be a viable, though challenging, plan.

- Considering Flagship vs. Regional Campuses: Sometimes, regional campuses within a state university system have lower non-resident rates or more generous scholarship pools.

- Private University Comparison: In some cases, a private university’s stated tuition, combined with its substantial endowment-funded aid, may result in a net price competitive with a public school’s non-resident rate.

Finally, for some students, the strategic choice is to attend a community college in the desired state for one to two years to complete general education requirements at a lower cost while working to establish residency, then transfer to the four-year state university. Each of these options requires careful research and early action during the college application and financial aid process. Understanding the full landscape of costs, including mandatory fees beyond tuition, is critical for accurate budgeting, as highlighted in our analysis of extra fees and hidden add-ons at many institutions.

The Broader Context and Ongoing Debate

The system of non-resident tuition exists within a larger, often contentious, debate about the funding and purpose of public higher education. Critics argue that high non-resident rates create barriers to geographic mobility and opportunity, effectively balkanizing the national education landscape. They contend that in an interconnected economy, all states benefit from a highly educated populace, regardless of where the degree was earned. Furthermore, as state funding for higher education has declined as a percentage of university budgets over recent decades, institutions have become more dependent on non-resident tuition revenue, leading to aggressive out-of-state recruitment. This can create a perceived tension between the institution’s mission to serve in-state students and its financial need to enroll high-paying non-residents.

Proponents of the current model maintain that it is a fiscally responsible and fair approach. They emphasize the fundamental principle that those who fund a public good should be its primary beneficiaries. The model also incentivizes states to invest in their own higher education systems to retain talented students. The debate often centers on finding the right balance: enough non-resident students to provide revenue and diversity, but not so many that they displace qualified in-state applicants. This balancing act is a constant focus of university administrators and state legislators.

Ultimately, the practice of charging non-resident tuition is a cornerstone of the public university financial model. It is a direct reflection of the institution’s obligation to its state taxpayers and a necessary tool for maintaining fiscal health and educational quality. For students and families, understanding this rationale is the first step in making informed decisions. By researching reciprocity agreements, targeting merit scholarships, and carefully comparing total net costs across different types of institutions, the dream of attending a public university in another state can remain financially attainable. The price differential is not an arbitrary penalty, but a logical outcome of how America chooses to fund its public higher education system.